By the Numbers: Who American consumers will blame for tariff price increases

Companies will bear at least part of the blame.

New tariffs — and the threat of more on the horizon — are keeping both American consumers and companies on their toes.

While it’s too early for a full picture of how existing and proposed tariffs may impact the global economy, or which tariffs will even go into effect, it’s certainly time to get messaging in order to help Americans understand why prices are changing.

Data can help.

New research from Morning Consult digs deep into how Americans view these tariffs — and where they’ll place blame if they hit them in the pocketbook.

Here’s what we can learn.

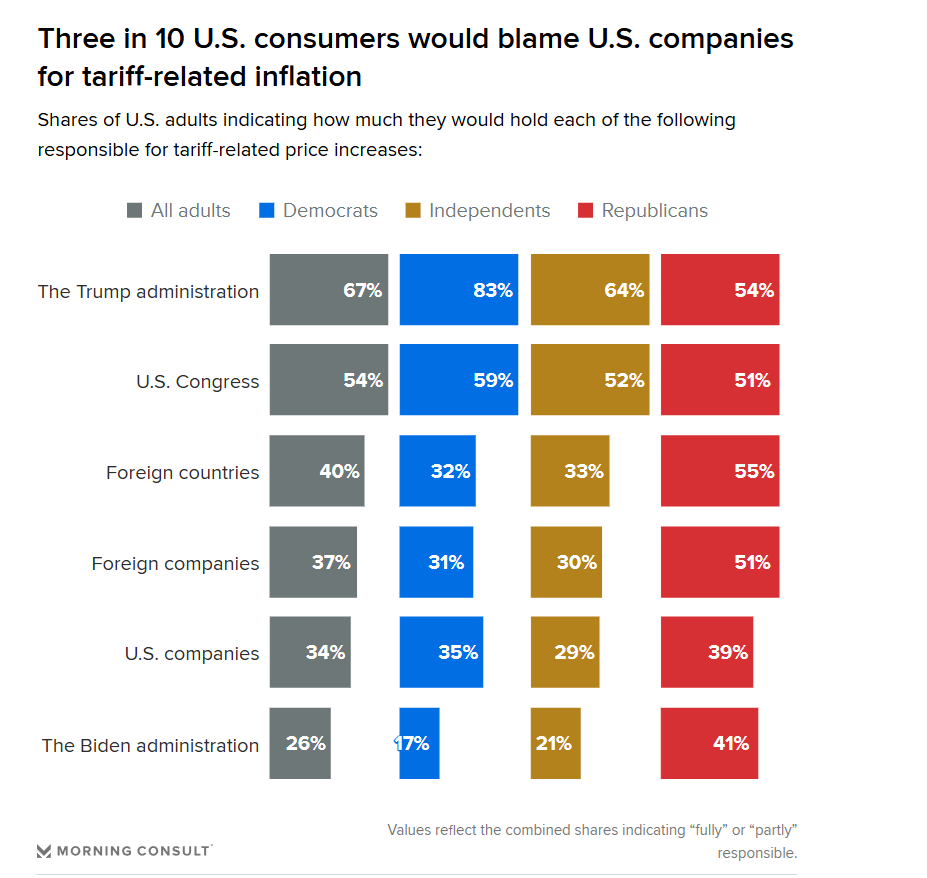

Companies will take some blame

When it comes to pointing the finger at tariff-related price increases, there’s plenty of blame to go around. Morning Consult’s data finds that while the lion’s share of blame will go to the Trump administration (67%) and Congress (54%), companies will be in the crosshairs as well. Thirty-seven percent of respondents said they’d put the blame on foreign companies while 34% will turn their ire on American companies.

While U.S. companies are near the bottom of the blame list, one in three Americans will still hold companies accountable. That means communications around how prices are increasing, why and for how long will be vital.

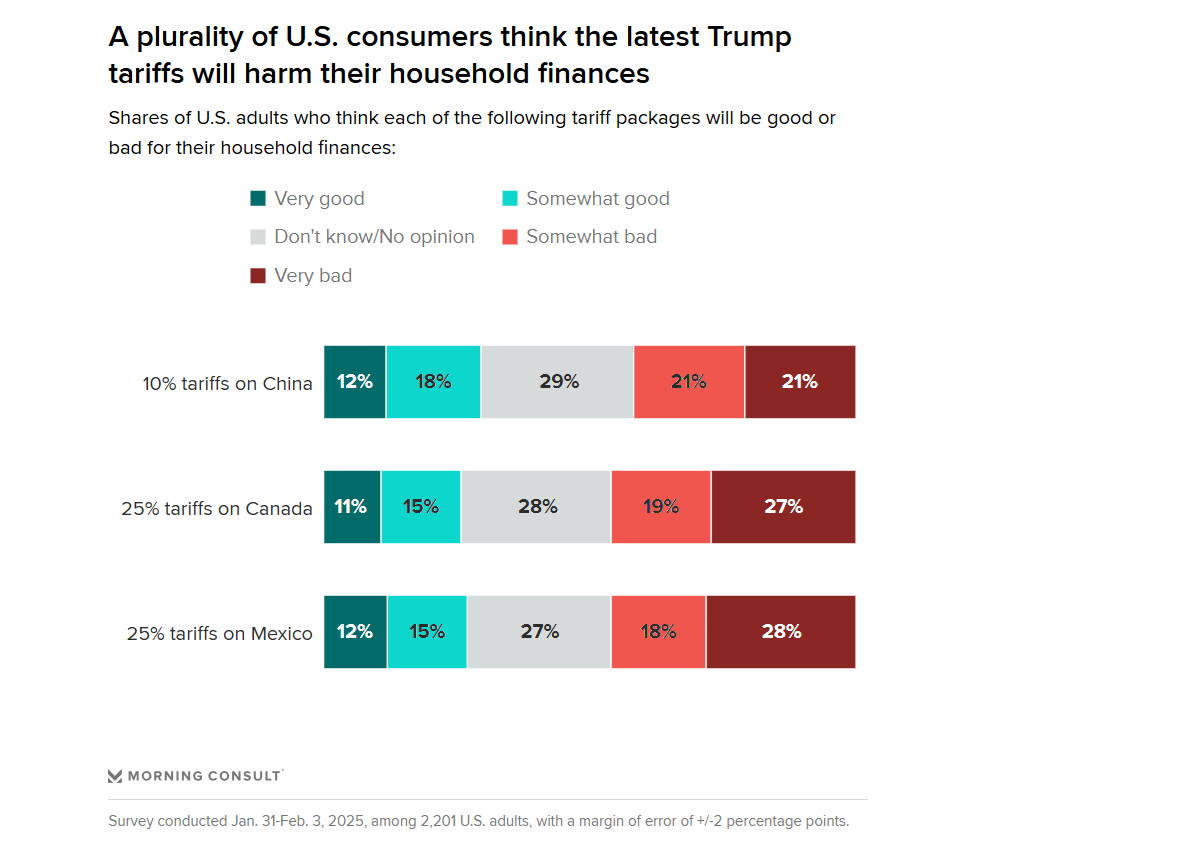

And that blame could have a big impacton spending behavior, as just under half of Americans anticipate that tariffs will negatively impact their finances. Slightly more Americans are concerned about tariffs against Mexico and Canada than against China, but still, more than 40% remain concerned even about these lower, 10% tariffs.

So, to blend these two findings: A plurality of Americans believe tariffs will cost them money. And one-third of Americans will blame companies for that pain.

It’s bad news, especially when companies can do little to actually impact these tariffs, outside of lobbying and supply chain changes.

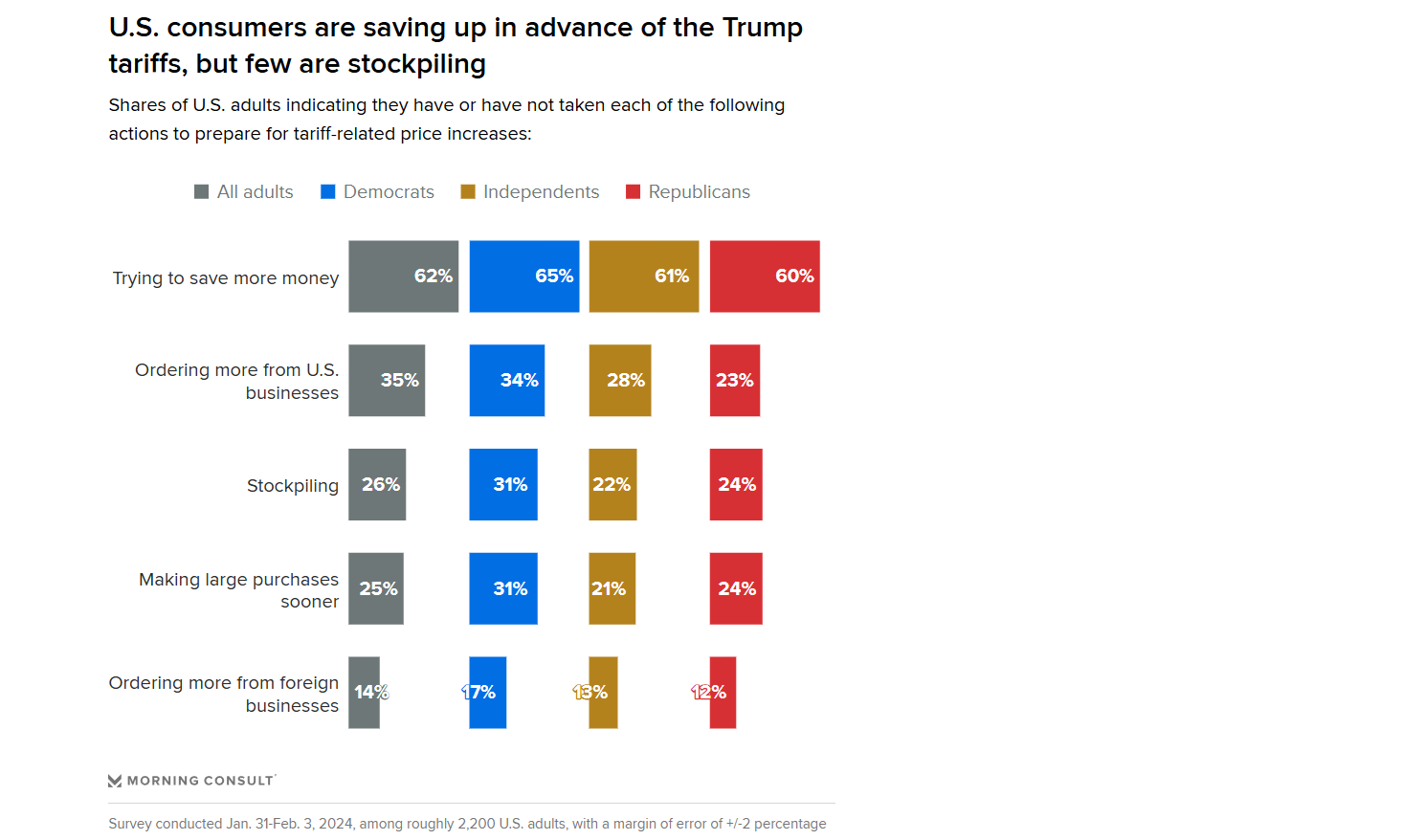

One might think that Americans will prepare for these tariffs by making purchases sooner or by creating a stockpile of price-sensitive items before prices increase, which might at least lead to a short-term bump in sales for some companies.

But that isn’t borne out by the data. On the contrary, at least in the short term, 62% of respondents are attempting to save money, which could lead to short-term hits to the bottom line as consumers seek to pull back on discretionary spending. Only 26% of respondents said they would stockpile goods, while 25% said they would prioritize larger purchases. It all paints a picture of an economy that’s stuck in “wait and see” mode as both consumers and companies attempt to see which policies solidify and what their trickle-down impacts will be.

What communicators can do

Communicators are going to be tasked with explaining complex economic concepts to a populace that will likely be grumpy about increasing prices. Whenever possible, look for opportunities to show how your organization is working to absorb the impact of price increases or find creative ways to hold prices steady (or at least, lower). This is a time when the importance of being American-made will become more important than ever, not merely because of nationalistic pride but because of price differentials. But this will become increasingly complex as steel and aluminum tariffs begin to hit, which will likely impact even products made in the USA.

Stay calm. Stay empathetic. Work to understand the true business impacts of tariffs so you can act as the translator audiences need to see how that will impact what they pay. Look for opportunities to speak in plain language, perhaps with the help of infographics or other visual aids.

Above all, stay flexible. More change will come.

Allison Carter is editorial director of PR Daily and Ragan.com. Follow her on LinkedIn.